Batteries and Their Role in the Energy Market

Batteries in the energy space.

Introduction

Recently, I turned my attention towards batteries and their (potential) role in the energy market.

We often come across posts and analyses that promote investing in and deploying batteries. While these discussions highlight potential benefits, it's worth taking a closer, structured look at what using batteries actually involves—beyond just the promise of "green tech" or "energy storage." This article will explore usage models rather than the physical or chemical properties of battery systems.

Common Use Cases

Arbitrage -Buying electricity when prices are low, storing it, and selling (or using) it when prices are high. Profit depends on market price spreads and battery efficiency.

aFRR (Automatic Frequency Restoration Reserve) – Participating in grid balancing by automatically adjusting power output in response to frequency deviations. This demands fast response and high reliability.

FCR – Fast response services to support grid frequency.

Demand Charge Reduction – Reducing peak power demand charges by using stored energy during high-load periods. Especially relevant for commercial and industrial consumers.

Key Battery Attributes

Max Capacity (kWh) – The total amount of energy the battery can store.

Max Power (kW) – The maximum rate at which the battery can charge or discharge.

Round-Trip Efficiency – The ratio of energy retrieved from the battery to the energy used to charge it.

Initial & Replacement Costs – The capital expenditure required to purchase and install the system.

End-of-Life Capacity – The capacity level (as a % of original) at which the battery is considered no longer economically viable.

Cycle Life (at % DoD) – The number of charge/discharge cycles the battery can perform at a given DoD before reaching its end-of-life threshold.

O&M Costs – Recurring costs for running the system, including maintenance, software, and possibly leasing.

Cycles per Day – How often the battery is charged and discharged in a typical day. This metric impacts both revenue and degradation.

Simple Use Case: Financial Model

I modeled a 100 kWh battery used primarily for arbitrage, with the following parameters:

Example parameters

"Initial Capacity (kWh)": 100,

"Cycle Life at 80% DOD": 4000,

"Round-trip Efficiency": 0.9,

"End of Life Capacity (%)": 0.7,

"Initial Cost (€/kWh)": 400,

"Replacement Cost (€/kWh)": 300,

"Annual O&M Cost (€)": 1000,

"Cycles per Day": 1,

"Electricity Arbitrage Value (€/kWh)": 0.20,

"Frequency Regulation Revenue (€/year)": 1000,

"Demand Charge Reduction (€/year)": 500,

"Discount Rate": 0.08Results: IRR and NPV

Cumulative Cash Flow Over Time

Discounted NPV IRR

| Arbitrage Scenario | NPV (€) | Payback Period | IRR |

|---|---|---|---|

| €0.15/kWh | -7,085.06 | 8 years | 3.71% |

| €0.17/kWh | -2,158.41 | 6 years 11 months | 6.73% |

| €0.20/kWh | 2,768.24 | 6 years | 9.59% |

Insight: Although we break even, still in some scenarios, our discounted cash will be still negative.

Sensitivity Analyses

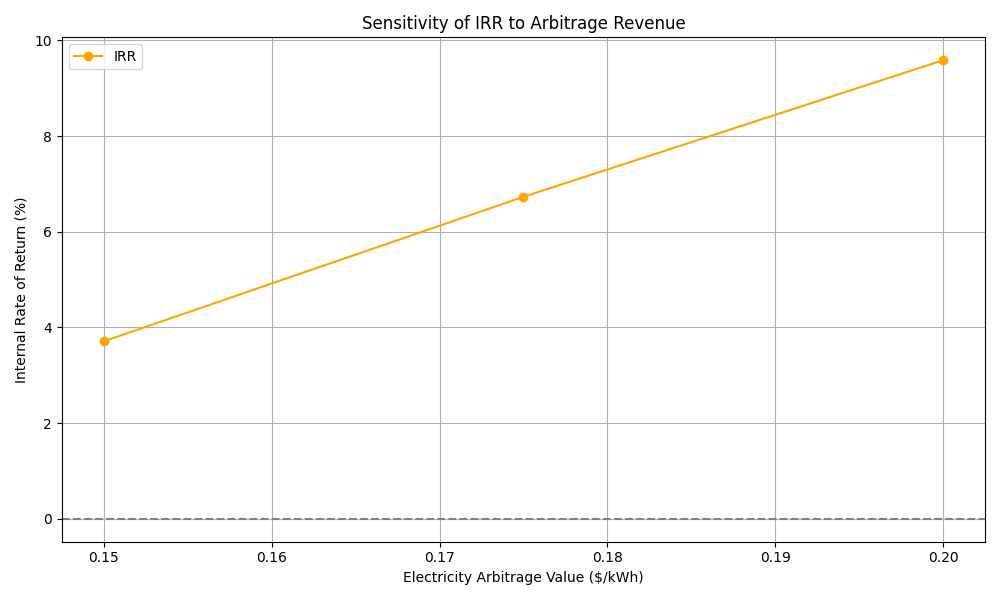

1. IRR vs Arbitrage Value

More the better, linearly.

2. NPV vs. Arbitrage Value

Insight: The breakeven arbitrage value is about $0.187/kWh.

Caveats and Assumptions

Price-taker assumption: The model assumes that the battery’s operation doesn’t influence market prices. This is only valid if the battery’s capacity is tiny relative to market volume.

Retail vs Wholesale: At the retail level, arbitrage value might be governed by self consumption.

Closed-loop control: Optimization is usually performed by generic control software or manual schedules, which can’t effectively react to real-time conditions without a closed-loop energy control system. Current technology is power control, open loop. The Energy(kWh) needs to have a closed loop system. Extra complexity and costs.

Wholesale markets:

Day-Ahead (DA): Requires bidding before prices are finalized. Prediction and commitment risk are significant..

Intraday Continuous: Needs advanced forecasting and algorithmic trading capabilities. You are now competing with professional trading outfits.

Market saturation risk:

Competition: If too many batteries enter the arbitrage space, price spreads narrow.

Large volumes: You could become a price-maker, reducing its own profitability.

Arbitrage induced cycle intensity: Profitable arbitrage scenarios might cause extra cycles, thus shortened battery life.

Compare to stock

S&P-500

10 years on avg 8% interest: 40,000 EUR -> 86,319 EUR.

Which is exactly 40,000 EUR NPV.

So, in order to beat the stock market we need to have battery NPV > 40,000 EUR

Other considerations

Sustainability

Integrate intermittent renewables like solar and wind,

Reduce reliance on fossil fuel peaker plants,

Lower carbon emissions from grid operations.

Grid Services & Reliability

Grid stability (frequency and voltage regulation),

Backup power during outages,

Supporting microgrids and energy resilience in remote or vulnerable areas.

Policy, Incentives & Regulation

The NPV could change overnight with:

Feed-in tariffs

Capacity payments

Carbon pricing

Grid access fees

Tax incentives or subsidies

Technological and Operational Risk

Battery degradation rates can vary by chemistry, climate, and usage.

Energy management software quality can make or break value capture.

Closed-loop control, prediction algorithms, and market access are non-trivial implementation challenges.

Community and Brand Impact

Support local energy independence,

Align with corporate ESG goals,

Enhance public image or stakeholder engagement.

Final Thoughts

Financial metrics like NPV, IRR, and payback period are essential when evaluating battery storage — especially when compared to alternatives like stock market investments earning ~8% annually.

But investment decisions rarely live in a vacuum. Beyond the spreadsheet, there are broader, often equally important, factors to consider:

While batteries can be a solid investment under the right conditions, their true value often goes beyond the bottom line. Like any infrastructure decision, it's about financial viability, system needs, and strategic goals — together.